oTMS and JDA Launch New China Consumer Survey

Page views: 2,336 times

Page views: 2,336 times

Shanghai, China. – October 9, 2018 – Today’s retail environment is more complex than ever, given the rise of ecommerce and a rediscovery of the age-old truth that “the customer is king.” As retailers across the globe struggle with demands for both personalization and convenience, balanced with consumer skepticism on data privacy, leading transport management platform oTMS and JDA Software, Inc., explored consumer trends in key markets in its 2018 China Consumer Survey, released today.

Shopping in-store remains the most popular experience globally (preferred by 38 percent), although online options were preferred in some of the surveyed countries. In China, over sixty-one percent of respondents say they like online shopping best. Regarding in-store shopping, Chinese respondents said that having variety of products in-store is the most important aspect of their shopping experience (25 percent), followed closely by having a unique brand experience, along with a personalized service.

With high smartphone ownership rates across many of the nations surveyed, it’s not surprising that online channels are the first stop on most shoppers’ journeys, no matter how or where they finally make a purchase. This year’s survey found that shoppers in China start searching online for clothes (29 percent), home goods (26 percent) and electronics (35 percent). Younger consumers (ages 18 to 34) said they’re more likely than average to begin their shopping journeys with recommendations from friends or family.

“This notion that stores are dying or there is a ‘retail apocalypse’ is exaggerated. Instead, this is a time for a retail rebirth,” said Patrick Viney, vice president, global industry strategies, JDA. “While the industry may refer to it as ‘omni-channel’ retailing, consumers across the globe no longer strongly distinguish between online and in-store channels. All retailers are struggling with balancing the personalization traditionally offered through e-commerce shopping with the convenience of an in-store experience. We see this time and again as more e-commerce retailers are opening brick-and-mortar shops, and traditional retailers are looking to strengthen their digital and direct-to-home fulfillment.”

Technology and the Shopping Experience

Globally, the majority of respondents who shop in physical retail stores have used some form of emerging technology such as augmented reality (AR), mobile coupons and robots in the customer experience and customers’ demand for those technologies. Despite recent headlines questioning the value of these in-store technologies, 98 percent (99 percent for China) of those who have used these technologies said that this new technology sometimes or always enhanced customer experience.

When asked about the potential of AR, 90 percent of Chinese people said they’d be somewhat or much more likely to make a purchase if they could use AR to preview the product. But among shoppers worldwide who had actually used AR technology, 60 percent said they’d be somewhat or much more likely to purchase if they could use AR to preview before buying.

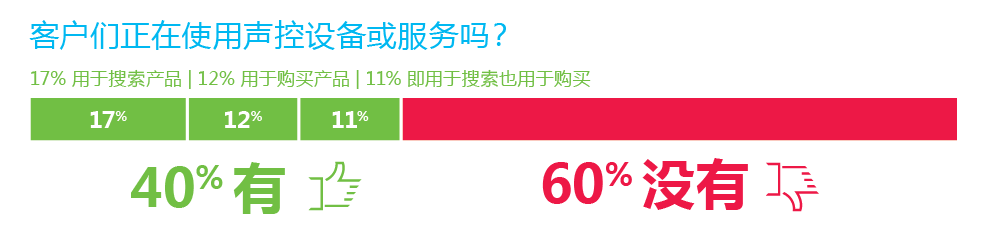

According to the global survey, 40 percent of respondents have used voice-controlled devices or services for some aspect of their shopping journey (ex: Siri, Alexa, Google Home, T-mall Genie, etc.). With devices such as T-mall’s Genie we expect China to follow suit with this trend.

Image 1: Are Customers Using Voice-Controlled Devices and Services?

Returns and Store Fulfillment Seen as Convenient, Time-Saving

The convenience factor of returning items to the store continues to be the primary driver for consumers. This year’s survey showed that 96 percent of consumers look for ease of returns as a key factor in their decision where to buy when shopping online, while 83 percent would be likely to switch to an alternative retailer for future online purchases if the returns process wasn’t easy. Interestingly, customers are almost equally happy to return items to a store (28%) or have a delivery service pick them up (32%), they aren’t comfortable with postal mail (17%) or having to take their returns to a collection point (16%).

“The volume of returns is increasing for a variety of reasons. As well as customers ordering multiple sizes, more than a third of Chinese respondents (33 percent) said that they returned items instore after they intentionally bought multiple sizes or product options for their own convenience,” said Viney. “This reverse logistics trend continues to cause problems for retailers, who are seeing repeat, serial returners. However, tangible rewards come from a good returns process: The survey showed that 82 percent of respondents claimed that they frequently or sometimes buy additional items when returning things to stores that they bought online, meaning returns can actually provide an opportunity to secure a sale by offering alternative items.”

However, the ease of returns doesn’t just apply to retailers that offer brick-and-mortar return services. According to the survey, 83 percent of those who shop for products online said that following a poor returns service from an online retailer, they were likely to switch to a different vendor for future purchases.

“Nowadays, retailers’ capabilities of online order tracking highly affect people’s choices of shopping channel,” said David Duan, co-founder and president of oTMS. “In order to meet consumers’ expectation, more and more brands are committed to building their own omni-channel logistics management capabilities, connecting factory, warehouse, store and consumer as an end to end and dynamic network to achieve real time visibility and traceability during the delivery stage.”

Product interpretation is the main factor driving customers to return online purchases to a retail store continues to be the primary driver for customers: 38 percent of respondents used this option because an item they’d purchased online wasn’t what they expected.

Methodology

This global survey was conducted by Opinium, a strategic insight agency, between late May to early June 2018. The findings are based on 12,000 online interviews with respondents in Asia (2,000 in China, 1,000 in India), Europe (2,000 in the UK, 1,000 in France, 1,000 in Germany, 1,000 in Italy, 1,000 in Sweden), North America (2,000 in the US) and Oceania (500 in Australia and 500 in New Zealand).